About e-Invoice

An e-Invoice functions as a digitized record of a commercial transaction involving a supplier and a buyer, effectively replacing the conventional use of paper-based or electronic invoice and accounting documents such as traditional invoices, credit memos, and debit memos.

Within this digital representation, it encapsulates all the fundamental particulars typically found in traditional invoices, encompassing critical information regarding the involved parties (supplier and buyer), itemized descriptions, quantities, pre-tax prices, applicable taxes, and the overall transaction value. This electronic invoicing method is designed to streamline record-keeping and financial transparency while diminishing reliance on traditional paper-based or email-driven documentation.

Benefits of e-Invoice

The adoption of e-Invoicing offers a dual advantage, delivering a smooth experience to taxpayers while enhancing operational efficacy and fostering greater tax compliance. The overarching benefits encompass:

- Mitigation of Manual Efforts and Human Errors

By centralizing the invoicing process, enabling the electronic creation and submission of transaction documents and data, the system effectively curtails the need for manual data entry, thus minimizing the likelihood of human errors. - Facilitation of Efficient Tax Filings

Through the seamless integration of systems, a robust infrastructure is established to facilitate efficient and precise tax reporting, ensuring that tax filings align with regulations and are executed accurately. - Optimization of Operational Efficiency

This system enhancement not only streamlines operations but also translates into notable improvements in efficiency, leading to substantial savings in both time and costs. - Digitization of Tax and Financial Reporting

The adoption of e-Invoicing harmonizes financial reporting and operational processes with industry standards by fostering digitalization, thus ensuring that tax and financial reporting are in line with contemporary practices.

- Mitigation of Manual Efforts and Human Errors

Overview of the e-Invoice Model

To facilitate the transition to e-Invoicing, taxpayers have the flexibility to choose the most appropriate method for transmitting e-Invoices to the Inland Revenue Board of Malaysia (IRBM), tailored to their specific business requirements and circumstances.

Taxpayers have two distinct options for selecting e-Invoice transmission mechanisms:

- MyInvois Portal

This portal is managed by the IRBM.

· It is accessible to all taxpayers at no cost.

· Furthermore, it is available to taxpayers who need to issue e-Invoices but lack an Application Programming Interface (API) connection. - Application Programming Interface (API)

· An API is a predefined set of programming code that enables direct data transmission between taxpayers’ systems and the MyInvois system.

· Implementing this option necessitates an initial investment in technology and adjustments to the existing systems of taxpayers.

· It is particularly suitable for larger taxpayers or businesses with substantial transaction volumes.

- MyInvois Portal

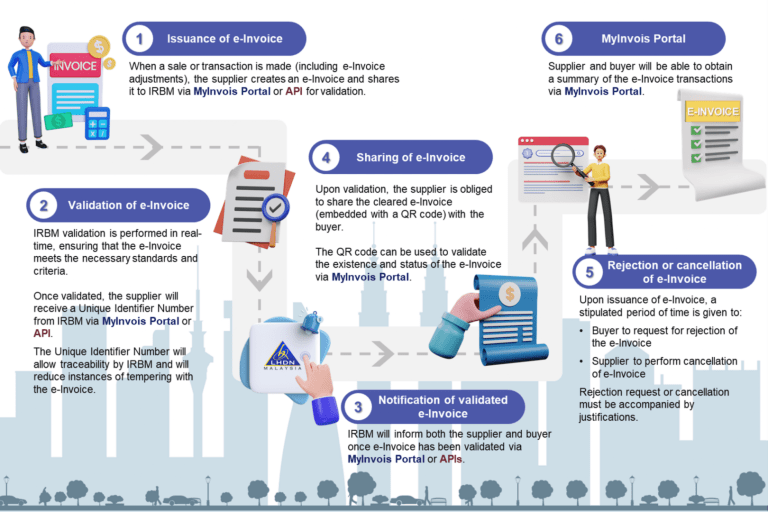

The diagram below provides an overview of the e-Invoice workflow, commencing from the point of a sale or transaction, when the supplier generates an e-Invoice through either the MyInvois Portal or the API, and extends to the storage of validated e-Invoices in the IRBM’s database, enabling taxpayers to access their historical e-Invoices.

e-Invoice Implementation Timeline

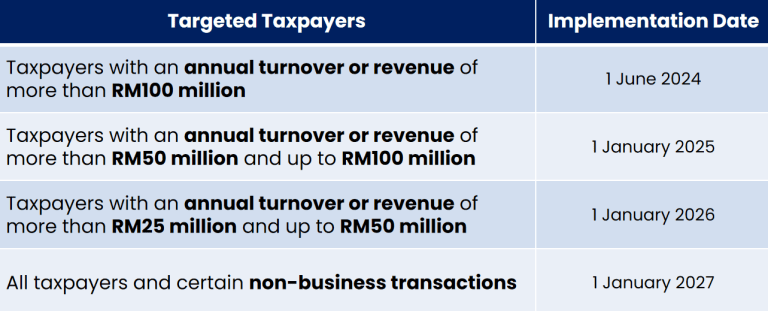

The introduction of e-Invoicing will occur incrementally to guarantee a seamless transition. The phased implementation of e-Invoicing has been meticulously structured, factoring in turnover or revenue thresholds, in order to afford taxpayers an ample timeframe for readiness and adjustment to this new system.

The following outlines the schedule for the e-Invoice implementation:

General Frequently Asked Questions

No, e-Invoice is applicable to both domestic and cross-border transactions. The cross-border transactions include import and export activities.

For clarity, the compliance obligation is from the issuance of e-Invoice perspective. In other words, taxpayers who are within the annual turnover or revenue threshold as specified in Section 1.5 of the e-Invoice Guideline are required to issue and submit e-Invoice for IRBM’s validation according to the implementation timeline.

IRBM is actively conducting a series of engagement sessions with industry players, tax practitioners, professional bodies and identified stakeholders to provide comprehensive information regarding the implementation of e-Invoice in Malaysia including:

- Sharing the planning of action plans, strategies, and status developments regarding the implementation of e-Invoice; and

- Obtaining feedback and views through two-way communication between IRBM and taxpayers on the implementation of e-Invoice.

IRBM will adopt the Continuous Transaction Control (CTC) Model where the validation is done in near real-time by IRBM.

All taxpayers are required to implement e-Invoice according to the annual turnover or revenue thresholds.

In relation to a company, the annual turnover or revenue threshold refers to the annual turnover or revenue value as stated in the statement of comprehensive income in the FY22 Audited Financial Statements.

Refer to Section 1.5 of the e-Invoice Guideline for further details.

Currently, there are no industries that are exempted from the e-Invoice implementation.

Note that certain persons and types of income and expense are exempted from e-Invoice implementation. Refer to Section 1.6 of the e-Invoice Guideline for further details.

Yes, all businesses will be required to issue e-Invoice in accordance to the phased mandatory implementation timeline, which is based on the business’ annual turnover or revenue threshold.

Yes, there is a 72-hour timeframe for the e-Invoice to be cancelled by the supplier. Refer to section 2.4.6 of the e-Invoice Guideline for further details.

Yes, a Software Development Kit (SDK) will be provided to facilitate system integration.

e-Invoice Guideline and Catalogue

- Download e-Invoice Guideline Version 2.0 (published on 29 September 2023)

- Download e-Invoice Specific Guideline Version 1.0 (published on 29 September 2023)

- Download e-Invoice Catalogue (published on 12 October 2023)